Retail Experience Strategy

Client: Banco Azteca

Role: Creative Director

Year: 2017

Project Duration: 18 weeks

The Ask

Banco Azteca wanted to create a new experience inside their retail locations. One that would help them raise their image in the market, decrease lines in branch, and help their customers bridge the gap to become digital users.

The Challenge

With over 1500 existing locations, and plans to build new ones, we had to come up with a solution that could scale and meet the complex needs of various environments that ranged in physical space, transaction volume, connectivity, etc.

What we delivered

Building on experience principles from a previous engagement with the bank, we created a series of experience zones, each designed to serve different types of interactions; but all that deepen engagement, create more trust in the brand, and close the gap to digital banking.

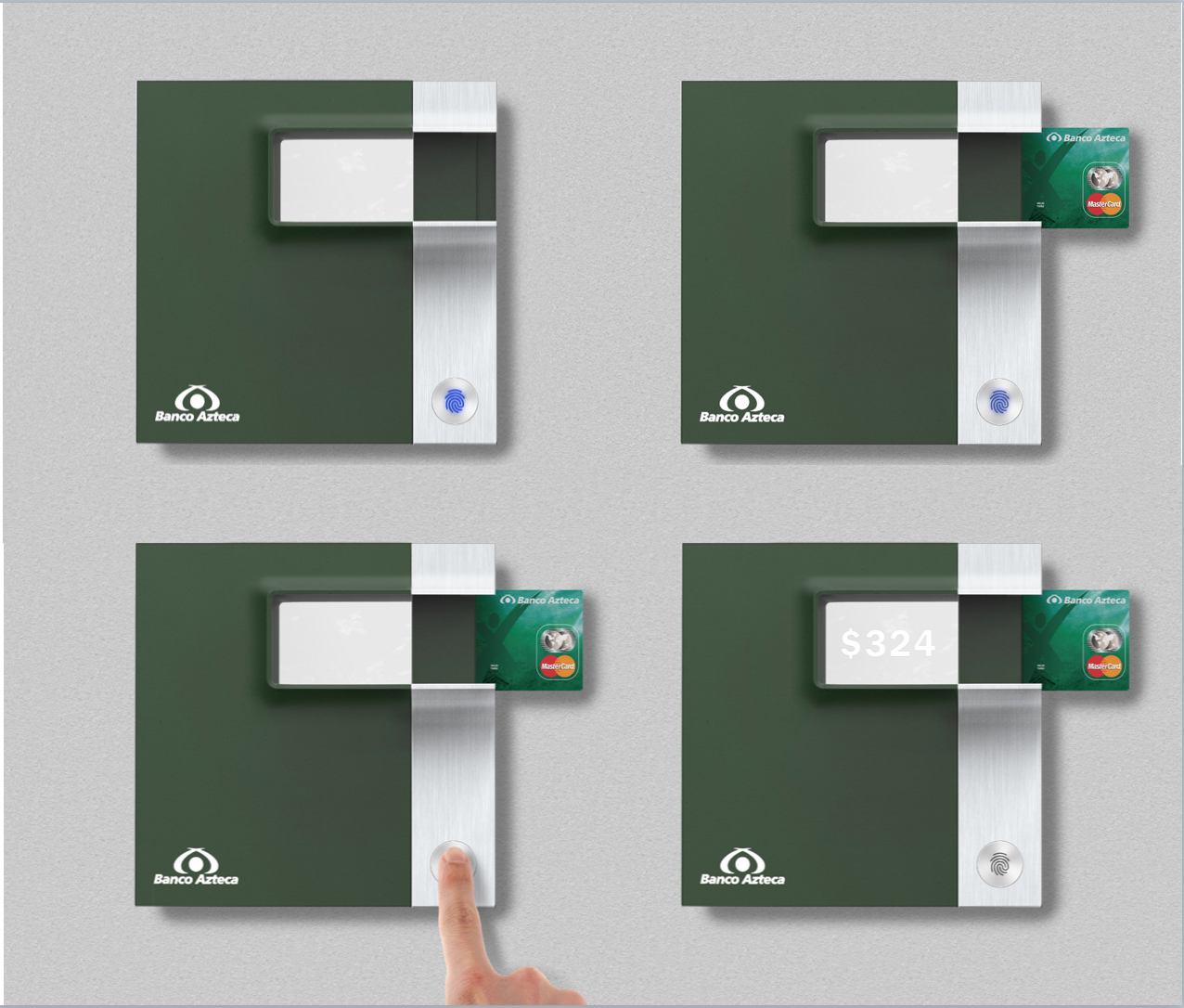

A series of digital touch points. These devices are intended to serve different needs in different zones of the bank.

Customers wait an average of 22 minutes to speak with a teller. Almost 1/3 of those only want to check their bank balance.

The balance checker is a small device that can offload from teller lines, and still meets the bank’s security standard of biometric identification.

Meeting customer’s needs appropriately

Whether it is a balance checker or a “cashless ATM” that lets users perform a number of transactions without a full ATM, we created an ecosystem of device touch points that can not only help customers adapt to digital behaviors, but can be leveraged to extend new ways to access customer service.

The cashless ATM can be used to perform virtual transactions, and serves as good primer for mobile banking interfaces.

This small format can also be used to video conference with a teller or specialist.

A moment of refresh

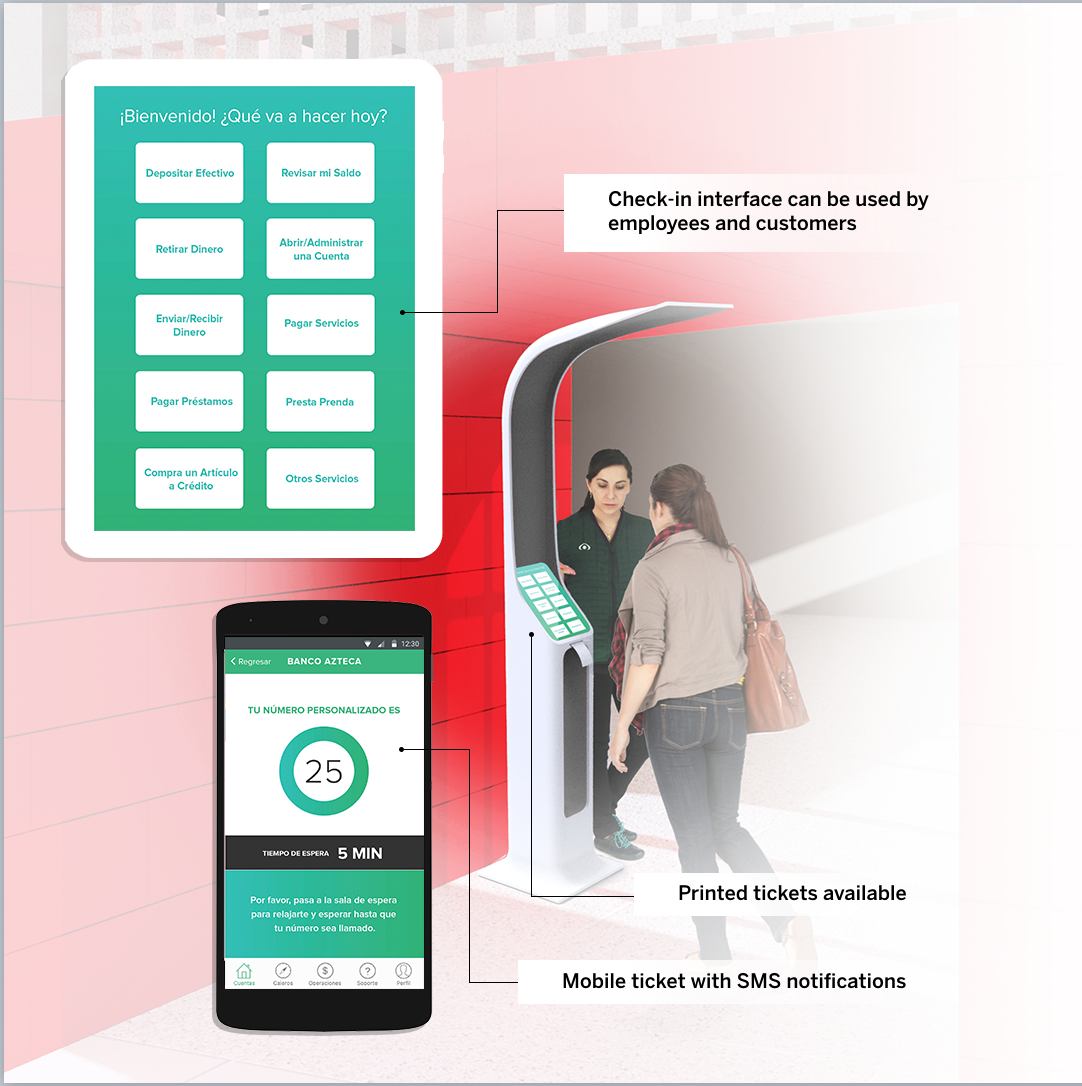

Banco Azteca branches are exclusively found inside Elektra retail stores. To reset expectations and refresh a customer’s mindset, we created a digital check-in kiosk, which serves as way to acknowledge the change from a retail environment of shopping for appliances and home goods to banking mode, and to direct customers away from the teller line and into newer, more efficient digital touch points when appropriate.

The kiosk is intended to be self service or assisted.

ATMs completely re-thought

Many customers complained current ATMs are risky, whether because of lurking strangers, or just broken or out of cash. A new ATM design that values privacy and inspires trust is a big part of the new bank experience. Mirrored laminates on the screens, hoods and recessed cash trays afford total privacy. Other details help assure customers that the device is online, has cash, and that their transactions would go through.

Friendlier interiors

The digital tough points can serve to update any existing locations. Moving forward, we also created recommendations around how to build friendlier interiors with amenities from seating, signage, to teller layouts that will drive value for customers and more business for Banco Azteca.

For more information about this or any other case study on this site, please contact me at daniel.holtzman@gmail.com